Venture Client Stories

Venture Clienting: Definitions and history

Introduction

At the time of this publication (2025) the term “Venture Clienting”, and related terms such Venture Client Model, are strongly gaining in popularity. Venture Clienting is now used world-wide by renowned companies and business schools globally in the context of corporate venturing. Before 2014, the term did not exist or was used in that context. There was no model and no organizational unit for Venture Clienting. There were no academic courses, publications or research activities. There was no company offering Venture Client specific services, technology tools and data to companies. The term did not even exist in Wikipedia.

As Venture Clienting gains popularity, so does the curiosity around it - leading to more questions, discussions, and evolving understandings of what it truly means.

This article tackles the fundamental question at the heart of these conversations: What is Venture Clienting - why, where and how did it emerge and evolve? I answer this by systematically tracing and analyzing the historical development of Venture Clienting, beginning with its birth in 2014 and following key milestone events through 2025. From these, I deduct fundamental definitions of Venture Clienting and its core terminology, providing conceptual clarity for companies and future academic research.

TI hope the factual events and insights described in this article contribute to a deeper understanding of Venture Clienting, and also actively drives the impactful adoption and continuous advancement of Venture Clienting as a strategic business function.

Note: I actively conduct and support academic research on Venture Clienting and regularly publish findings. Check my Google Scholar profile or follow me on Medium for updates on new publications.

Definitions of Venture Clienting and related terms

The definitions of Venture Clienting and related terms - Venture, Venture Client, Venture Clienting, Venture Client Model, and Venture Client Unit - are grounded in the key milestone events shaping its history from 2014 to 2025, as outlined below. These definitions clarify this novel approach to corporate venturing, making it practical for companies while laying the foundation for future discussions and research.

What is Venture Clienting?

Venture Clienting refers to the activities a company undertakes to adopt startup products through procurement and M&A, with the purpose of innovating existing products, processes, or infrastructure or introducing entirely new offerings. These activities can be formalized through a Venture Client Model and executed within an existing business function or a dedicated Venture Client Unit.

Although Venture Clienting was coined and formalized at BMW in 2014, its core principle - corporate value creation through startup adoption - existed for decades in an unstructured, transactional manner within generic functions such as procurement, IT, or R&D. BMW’s 2014 breakthrough transformed it into a formal business function, allowing corporations to institutionalize startup adoption at scale. This shift elevated Venture Clienting from an ad-hoc practice to a high-impact, scalable strategy for corporate innovation and competitiveness.

It is important to distinguish this from the broader landscape of corporate venturing, where companies - including BMW - have engaged in various forms of corporate venturing for decades, aiming to derive benefits from startups. They have collaborated, invested, partnered, incubated, accelerated, and acquired startups, as well as purchased from them, ever since startups have existed. However, while Venture Clienting may support, include, contribute to, or overlap with these approaches, it is not synonymous with them. A company may collaborate or partner with a startup without ever using its product - Venture Clienting, by definition, requires adoption. Similarly, Venture Clienting does not exclude non-controlling minority investments (CVC), but these are neither a requirement nor its primary purpose.

To gain a deeper understanding of Venture Clienting, it is important to define related terms: Venture, Venture Client, Venture Client Model, and Venture Client Unit.

What is a Venture?

In Venture Clienting, a “Venture” refers to a startup backed by venture capital. It does not include corporate ventures - new businesses launched by established companies. This means that Venture Clienting is always about startups. In this article, “startup” and “venture” are used interchangeably.

For a more detailed definition, see the article What is a startup?.

What is a Venture Client?

A corporate Venture Client is a company that adopts startup products through procurement or acquisitions (M&A). While the term typically refers to companies, in principle, an individual can also be a Venture Client. What defines a Venture Client is the adoption of a startup’s product. In this process, any rights related to the product, such as patents, remain with the startup - unless the startup is acquired. Even if a company doesn’t successfully adopt a startup product, it still qualifies as a Venture Client as long as it actively seeks to do so. This definition excludes companies that only hire startups as contractors. In those cases, the startup’s workforce is used to support development efforts rather than providing a product. Any resulting rights belong to the company, not the startup - this is considered work-for-hire, not Venture Clienting.

What is a Venture Client Model (or Venture Clienting Model)?

A Venture Client Model is a structured management approach for systematically adopting startup products within a corporation. It defines the necessary capabilities, including processes (tasks and their sequence), resources (people, budget, software, data, etc.), and decision criteria for adopting startup products effectively through procurement and M&A.

Just as businesses operate under various models, different types of Venture Client Models can exist. The design of the model determines its effectiveness in generating business value. Each company should design and implement its own Venture Client Model, leveraging best practices while tailoring it to its corporate strategy to maximize competitive advantage.

The first Venture Client Model was created at BMW in 2014. It led to the creation of the BMW Startup Garage, as the first Venture Client Unit. See milestones below for details.

What is a Venture Client Unit (or Venture Clienting Unit)?

A Venture Client Unit is a dedicated business function within a company designed to systematically adopt startup products. It is formalized as an organizational unit with a defined name, brand identity, full-time team, structured processes, budget, and KPIs. The Venture Client Unit may be the core component of a company’s Venture Client Model, but companies may also implement Venture Clienting as a practice within existing functions such as strategy, M&A, corporate venturing, or innovation departments, without establishing a distinct unit.

The first Venture Client Unit was created at BMW in 2015: The BMW Startup Garage. See milestones below for details.

IMAGE

History of Venture Clienting: Key milestones

The history of Venture Clienting is outlined through milestone events, presented in chronological order. A Venture Clienting milestone is any event that had a significant impact on establishing Venture Clienting as a new approach to corporate venturing. Where applicable, I provide reference links to support the milestone and its significance.

1976 - First purchase of a startup product by a corporation

The foundation of Venture Clienting, in its broadest sense, was laid when a corporation first generated direct business value by adopting a venture-backed startup product. One of the earliest documented instances of such a transaction occurred in 1976, when Citibank purchased computer systems from the startup Tandem Computers. This purchase was significant because Tandem Computers was the first B2B startup backed by Kleiner Perkins, the first ‘modern’ venture capital firm founded in 1972. This milestone represents an early case of a corporation leveraging a startup’s technology through direct adoption - creating immediate business impact - without the need for a minority, non-controlling investment.

Significance: While Venture Clienting as a term and structured management practice was coined and formalized at BMW in 2014, its core principle - corporate value creation through startup adoption - predates its naming by several decades. Initially, Venture Clienting occurred only in an unstructured, transactional manner within a generic business function such as procurement, IT, or R&D, lacking a systematic approach. It was only in 2014 at BMW that Venture Clienting evolved into a formal business function and corporate venturing method, enabling corporations to institutionalize startup adoption at scale.

References: Tandem Computers Wikipedia, Kleiner Perkins History

2014 - Term “Venture Client” is coined at BMW

Gregor Gimmy, a BMW manager, coined the term “venture client” to describe a new approach to adopt startup innovations in BMW products and processes.

Significance: This milestone marked the transformation of Venture Clienting from an ad-hoc generic practice into a distinct high-impact, scalable business function, unlocking its full potential for corporate innovation and competitiveness. This milestone is foundational because it marks the birth of Venture Clienting as a distinct concept. The terms “Venture Client” and “Venture Clienting” had never existed before in the context of corporate venturing. By coining the term, Gregor Gimmy introduced a fundamentally new approach - one that positioned corporations as direct users of startup innovations rather than equity investors or startup mentors. Naming the concept was crucial for its communication, adoption, and differentiation from traditional corporate venturing models like Corporate Venture Capital (CVC) and accelerators. This milestone laid the groundwork for the structured development of Venture Clienting as both a business practice (Venture Clienting Model) and a business function (Venture Client Unit), ultimately enabling its adoption by corporations worldwide.

References: Article: Harvard Business Review: What BMW’s Corporate VC Offers That Regular Investors Can’t, Book: Buy, don’t invest: The Venture Client Model - A Paradigm Shift in Corporate Venturing

2014 - Venture Client “Model” developed at BMW

Gregor Gimmy, recognizing that traditional technology adoption methods like procurement, partnering were not suited for startups, developed a structured approach that allowed BMW to engage with startups effectively at scale and with minimal risk. The Venture Client model developed was also fundamentally different from existing corporate venturing methods such as Corporate Venture Capital (CVC) and accelerators. By defining the necessary capabilities, the model established a repeatable and scalable business function, enabling companies to systematically integrate startup innovations across their entire value chain.

Significance: This milestone marks the formal creation of Venture Clienting as a distinct business practice focused on integrating startup innovations directly into corporate products and processes. It provided a scalable alternative to traditional corporate venturing approaches. This breakthrough laid the foundation for broader corporate adoption across multiple industries and geographies. The model pioneered at BMW was later refined and implemented by 27pilots at corporations such as Bosch, Siemens, and Airbus, further accelerating its global adoption.

References: Article: Harvard Business Review: What BMW’s Corporate VC Offers That Regular Investors Can’t, Book: Buy, don’t invest: The Venture Client Model - A Paradigm Shift in Corporate Venturing

2015 - First corporate Venture Client “Unit” is launched at BMW

BMW launches the first organizational unit exclusively focused on Venture Clienting, and named it BMW Startup Garage. Such a dedicated Venture Client Unit formed part of Gregor’s Venture Client Model. Gregor is head of the BMW Startup Garage from 2015 to 2018.

Significance: This milestone sets a precedent for other corporations like Airbus, Bosch, Holcim, Siemens and Otto Group to establish Venture Client units.

References: Harvard Business Review: What BMW’s Corporate VC Offers That Regular Investors Can’t, BMW (BMW Startup Garage), Bosch (Open Bosch), BSH (BSH Startup Kitchen), Holcim (Holcim Maqer), Otto Group (Otto Dock 6) and CAF (CAF Startup Station).

Video describing the BMW Startup Garage (Source: BMW)

2017 - First academic publication about Venture Clienting by Harvard Business Review

First academic and business recognition of Venture Clienting, reinforcing its distinction from traditional corporate venturing.

Significance: This milestone marks the first academic recognition of Venture Clienting as a corporate venturing function that addresses the inherent weaknesses of traditional approaches like Corporate Venture Capital (CVC). Published in the Harvard Business Review, one of the most influential management publications, this article positioned Venture Client Units as a new strategic vehicle for corporations to derive direct business value from startups. To date, this article is the most cited publication about venture clienting as per Google Scholar (as of February 2025).

References: Harvard Business Review: What BMW’s Corporate VC Offers That Regular Investors Can’t, Google Scholar

2018 - First Venture Client Solutions company is founded: 27pilots

The first Venture Clienting Solutions company, 27pilots, is started by Gregor Gimmy with BMW Startup Garage team members. Gregor Gimmy, as head of the BMW Startup Garage, recognizes the need of corporations for Venture Clienting specific services, technology and data. 27pilots pioneers the development and delivery of solutions to establish new corporate Venture Clients Units, and to help existing Venture Client Units to grow and improve. Multiple companies follow the lead of 27pilots, including global consultancies such as Deloitte, PwC and E&Y.

Significance: Creates a new market category in professional services, enabling broader corporate adoption of Venture Clienting.

References: 27pilots

2018 - First Business School Case about Venture Clienting by INSEAD

Professor Jörg Niessing from INSEAD Business School, writes the first business school case about a corporate Venture Client Unit, the BMW Startup Garage. The Case became a bestselling case, and is today taught at business schools across the world.

Significance: The first INSEAD business school case on Venture Clienting validates it as an academic subject and executive education topic. Studied by future corporate leaders, it enhances credibility, differentiates Venture Clienting from CVC and accelerators, and accelerates its adoption in corporate strategy.

References: How Corporates Co-innovate with Startups: The BMW Startup Garage

2020 - First Wikipedia entry of term the “Venture Client” by INSEAD Prof. Jörg Niessing on April 18, 2020

Professor Jörg Niessing (INSEAD) publishes a definition of the term Venture Client on Wikipedia.

Significance: This milestone matters because it marks the official recognition of “Venture Client” as a distinct concept in the public domain. Wikipedia serves as a widely accessible reference for executives, researchers, and startups, helping to spread awareness and establish a common understanding of the term.

References: Venture Client page in Wikipedia

2022 — First book about “Venture Clienting” is published on February 1, 2022

Gregor Gimmy publishes the first book exclusively dedicated to the topic Venture Clienting. The book articulates the strategic rationale for rethinking corporate venturing at BMW, explaining how this shift led to the creation of the Venture Client Model and the first Venture Client Unit. By providing a structured explanation of the Venture Client Process, it serves as a foundational reference for executives, innovation leaders, and researchers. Additionally, it differentiates Venture Clienting from traditional corporate venturing approaches like Corporate Venture Capital (CVC) and accelerators, reinforcing its legitimacy and strategic value.

Significance: This milestone marks the first comprehensive publication exclusively dedicated to Venture Clienting. The book contributes to accelerating global awareness and adoption by equipping companies with a strategic rationale for Venture Clienting.

References: Book: Buy, don’t invest: The Venture Client Model — A Paradigm Shift in Corporate Venturing, German version: Kaufen Statt Investieren! Wie Sie mit dem Venture-Client-Modell Start-ups strategisch nutzen

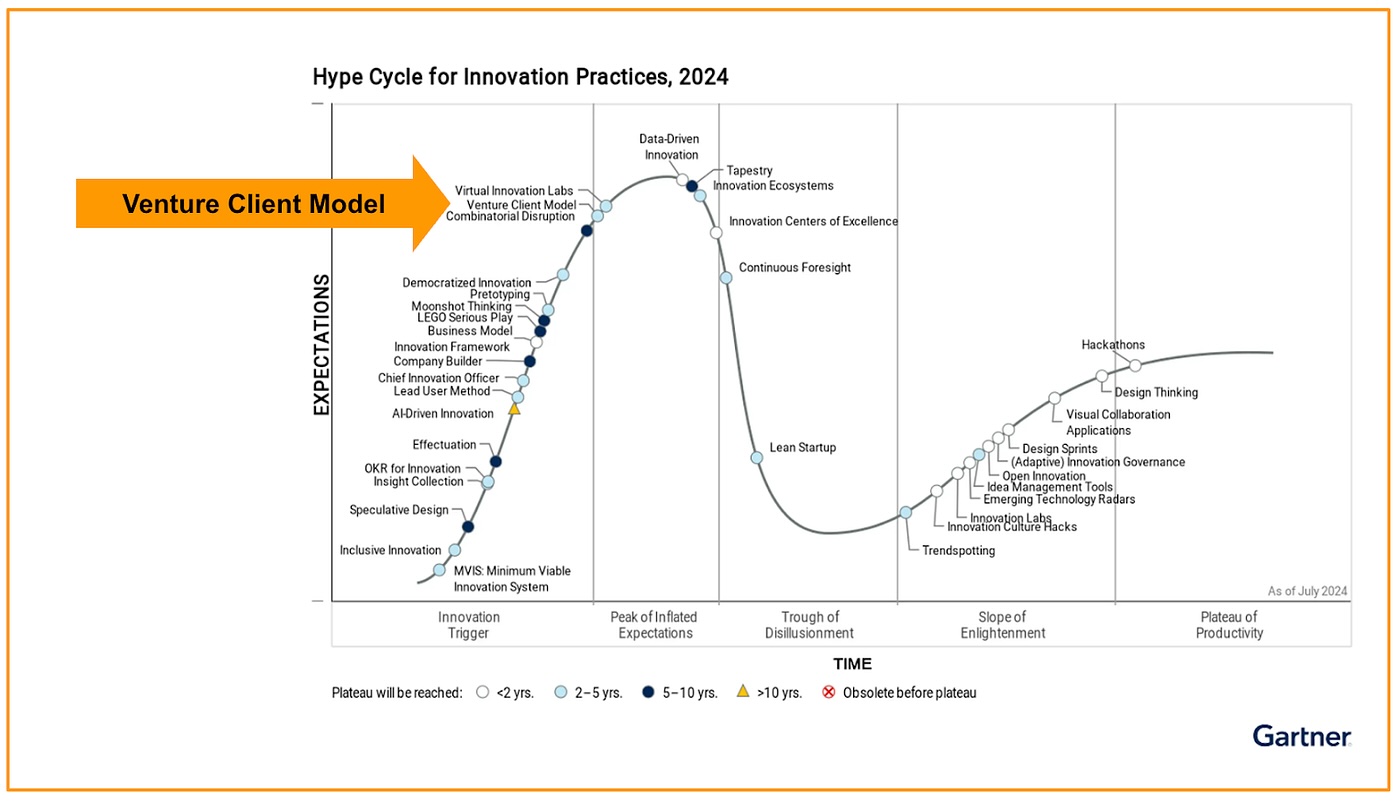

2024 - Venture Client Model selected for the 2024 Gartner Hype Cycle for new Innovation Practices

The Venture Client Model is included in the 2024 Gartner Hype Cycle for Innovation Practices. Gartner classifies the Venture Client Model as having a “High” benefit for corporations and estimates that it will reach mainstream adoption within 2–5 years.

Significance: Gartner’s inclusion of the Venture Client Model in its 2024 Hype Cycle for Innovation Practices serves as a major validation of its strategic relevance and business impact. The Venture Client Model stands out as the first corporate venturing and innovation practice ever included in a Gartner Hype Cycle, reinforcing its value and differentiation from traditional approaches such as Corporate Venture Capital (CVC) and accelerators, which have never been featured. This milestone increases global awareness, credibility, and adoption by positioning Venture Clienting as a high-impact business function that companies should institutionalize to drive competitiveness and innovation.

References: Gartner Report: Hype Cycle for Innovation Practices, 2024, Article: Venture Client Model: Reaching New Heights on the Gartner Hype Cycle

IMAGE

Conclusion: The Success of Venture Clienting

What started at BMW in 2014 has evolved into an established management practice as well as business function, shaping how corporations drive competitiveness with startups.

By 2025, Venture Clienting has been widely adopted by practitioners and academics:

- Hundreds of companies worldwide now use the term Venture Clienting to describe a new corporate venturing model and business function.

- More than 50 universities globally lecture, teach, or research Venture Clienting.

- Multiple firms now offer Venture Client Solutions that support companies to build, enhance and conduct Venture Clienting operations, including global consulting firms like Deloitte.

As the evolution of Venture Clienting and its adoption continues to expand across industries and academia, Venture Clienting is set to remain a defining force in corporate venturing worldwide.

See the yearly State of Venture Client Reports for insights about the evolution of venture clienting.

Acknowledgement

While many companies and individuals have been fundamental to the history and successful evolution of Venture Clienting - most notably my team at 27pilots and the dedicated Venture Clienting teams within corporations - one person stands out for his wisdom and his unique ability to inspire and motivate.

That person is Andreas König, Professor of Strategic Management, Innovation, and Entrepreneurship at the University of Passau. The spark that ignited my passion for Venture Clienting came from an insight he shared over breakfast in Lausanne in November 2015, making me realize that what I had considered a common business practice was, in fact, something groundbreaking. While Andreas had initially invited me to speak about innovation at BMW in general at a workshop at Nestlé, our conversation turned to my latest work with the BMW Startup Garage. It was at that moment that Andi opened my eyes to the true potential of Venture Clienting with a simple but profound remark that got the Venture Clienting history started:

“What you are doing is a true game changer!”

Related Articles

- Venture Clienting KPIs

Unlocking the Strategic Potential of Startups for Corporations: A Deep Dive into KPIs of Venture Client Units