Venture Client Stories

The Venture Client Edge: Five Compelling Reasons for Startups to Favor Venture Clients

Engaging with a Venture Client unlocks early revenue, real-world validation, and faster product-market fit.

Introduction

Technological innovation is the cornerstone of market dominance, but building and integrating new technology is risky and expensive. Startups supply much of the breakthrough tech incumbents need. The Venture Client Model lets corporations adopt startup products quickly, while startups gain early customers and proof points.

The Venture Client Model: Bridging Startups and Corporates

The model connects emerging startups with established companies to solve strategic problems using startup technology. Corporations get rapid solutions without equity entanglements; startups get early adopters willing to “venture” on their innovation.

Understanding the Venture Client Model

Unlike equity-based corporate venturing, Venture Clienting is centered on adoption, not ownership. It removes cap-table friction and focuses on deploying startup products through licensing, purchasing, or—when exclusivity is needed—acquisition. Apple’s use of Primesense tech for FaceID is a classic example of startup tech powering an incumbent product.

Advantages for Startups

Adoption by large companies is hard; Venture Clienting is designed to shorten that path. Here is what startups gain.

1) Expedited product-market fit and reduced time-to-market

Bypassing lengthy risk-mitigation processes lets startups land purchase orders faster. Deploying in real settings (not labs) accelerates iteration and decisions.

2) Enhanced expertise and product refinement

Startup teams get feedback from experienced domain experts inside the Venture Client company, refining the product to fit real operational needs.

3) Access to exclusive resources

Venture Clients open doors to infrastructure, data, and specialized know-how that are normally out of reach—without requiring equity.

4) Free PR and marketing opportunities

Successful deployments create powerful proof points and credibility. Unlike equity deals, startups earn revenue and visibility without dilution.

5) Eliminating investor risks and equity dilution

Because Venture Clients do not take equity, founders avoid dilution, shareholder conflicts, and signaling risk that can deter other strategic buyers or acquirers.

Conclusion: Venture Clienting — a catalyst for startup growth

The Venture Client Model speeds startup growth and product-market fit while helping corporations integrate frontier technology without capital risk. Target corporations with strong Venture Client Units to gain faster revenue, sharper feedback, and durable credibility.

Resources to learn more about corporate Venture Clienting

- Book: Buy, don’t invest: The Venture Client Model

- HBR: What BMW’s Corporate VC Offers That Regular Investors Can’t

- INSEAD Case: How Corporates Co-innovate with Startups: The BMW Startup Garage

Related Articles

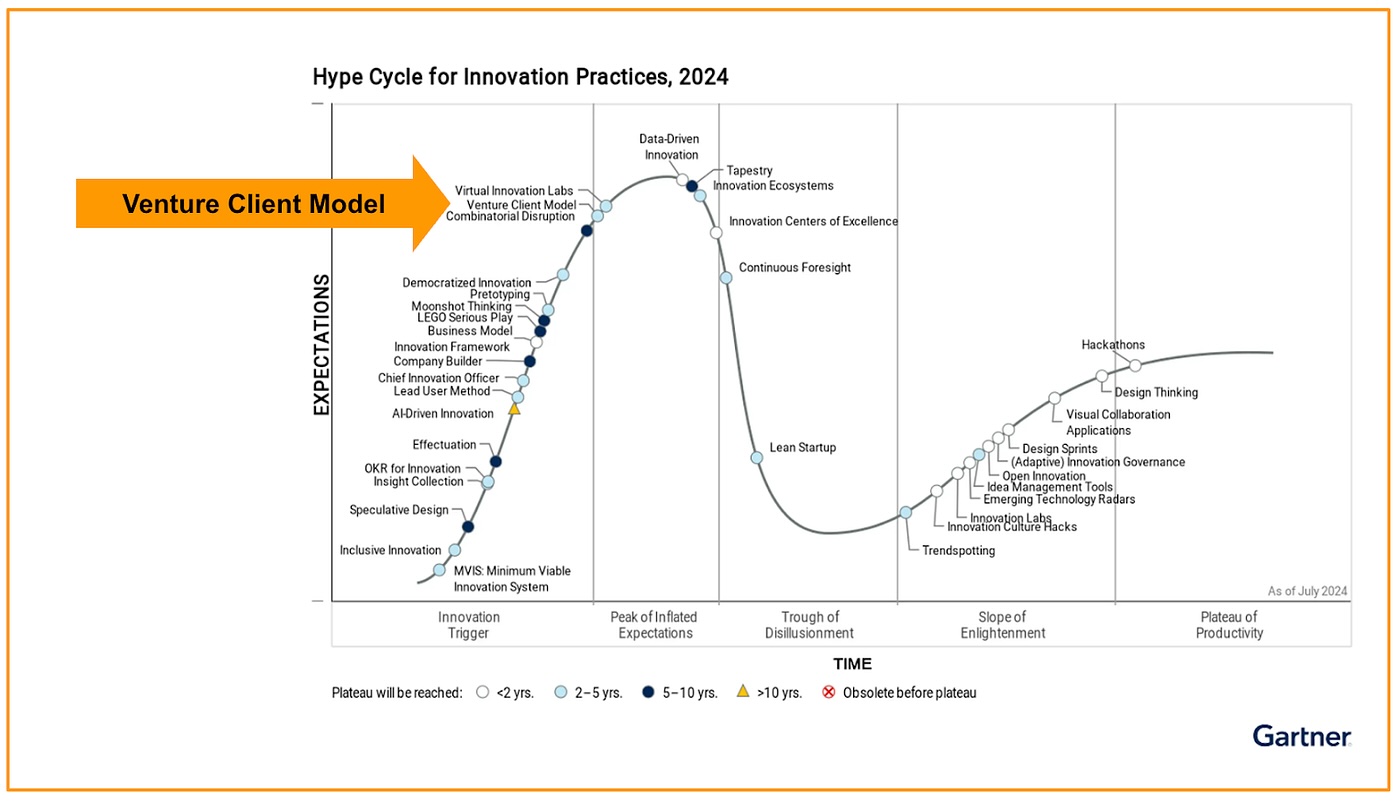

- Venture Client Model: Reaching New Heights on the Gartner Hype Cycle

The Venture Client Model made it to the Gartner Hype Cycle. Learn what this means, and how this model is transforming corporate venturing.